Copyright 2025 © All Rights Reserved. bayarzakat2u.com.my

Zakat On Gold

Zakat Payment Portal

Zakat Payment Portal

Fullfill Zakat Conveniently

1

Select the type of zakat to make payment for

2

Calculate the amount of zakat to be paid

3

Fill in information and make the payment

4

Get a receipt to claim your LHDN 100% tax rebate

Fullfill Zakat Conveniently

1

Select the type of zakat to make payment for

2

Calculate the amount of

zakat to be paid

3

Fill in your information and make the payment

4

Get a receipt to claim your LHDN tax rebate 100%

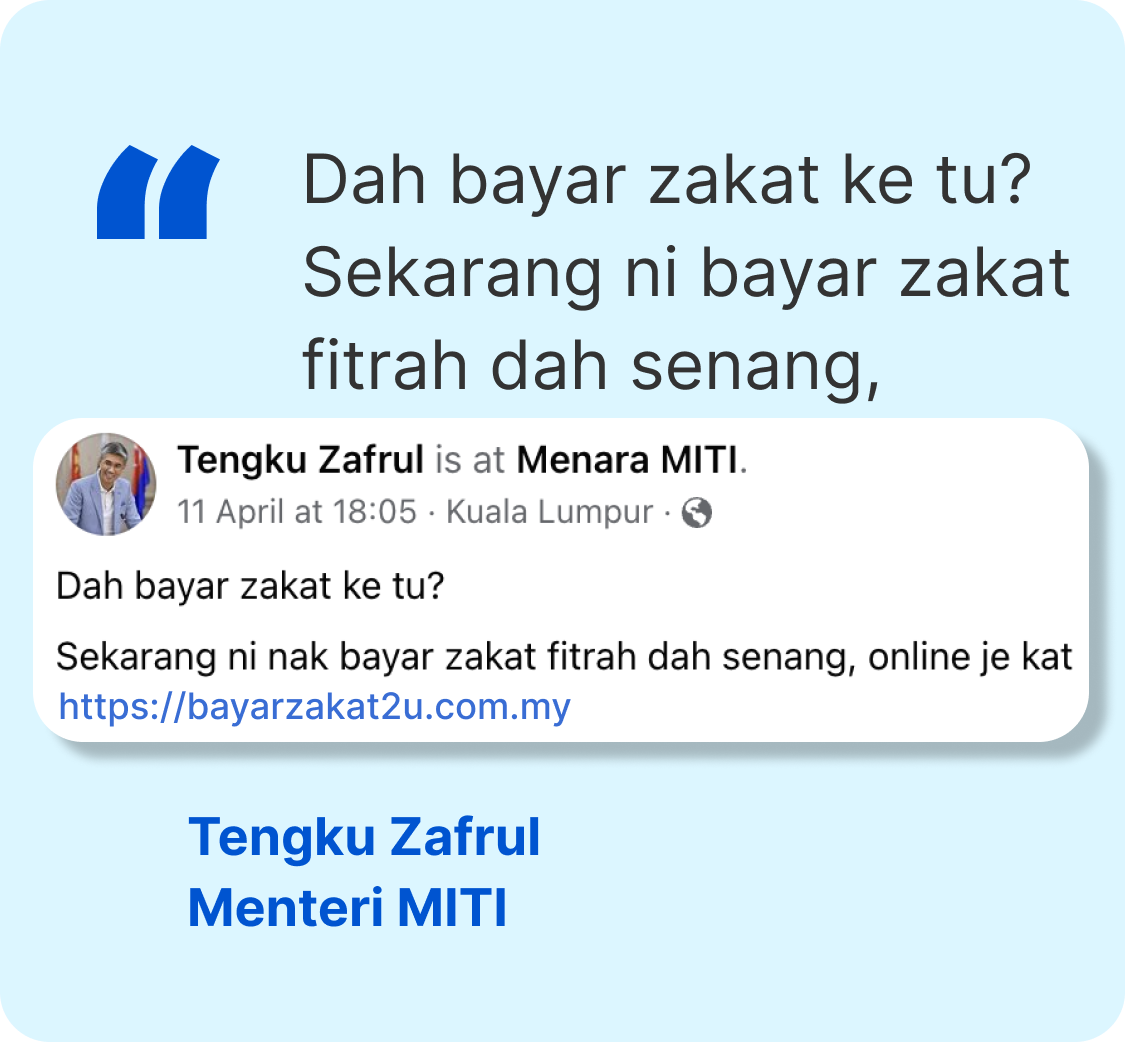

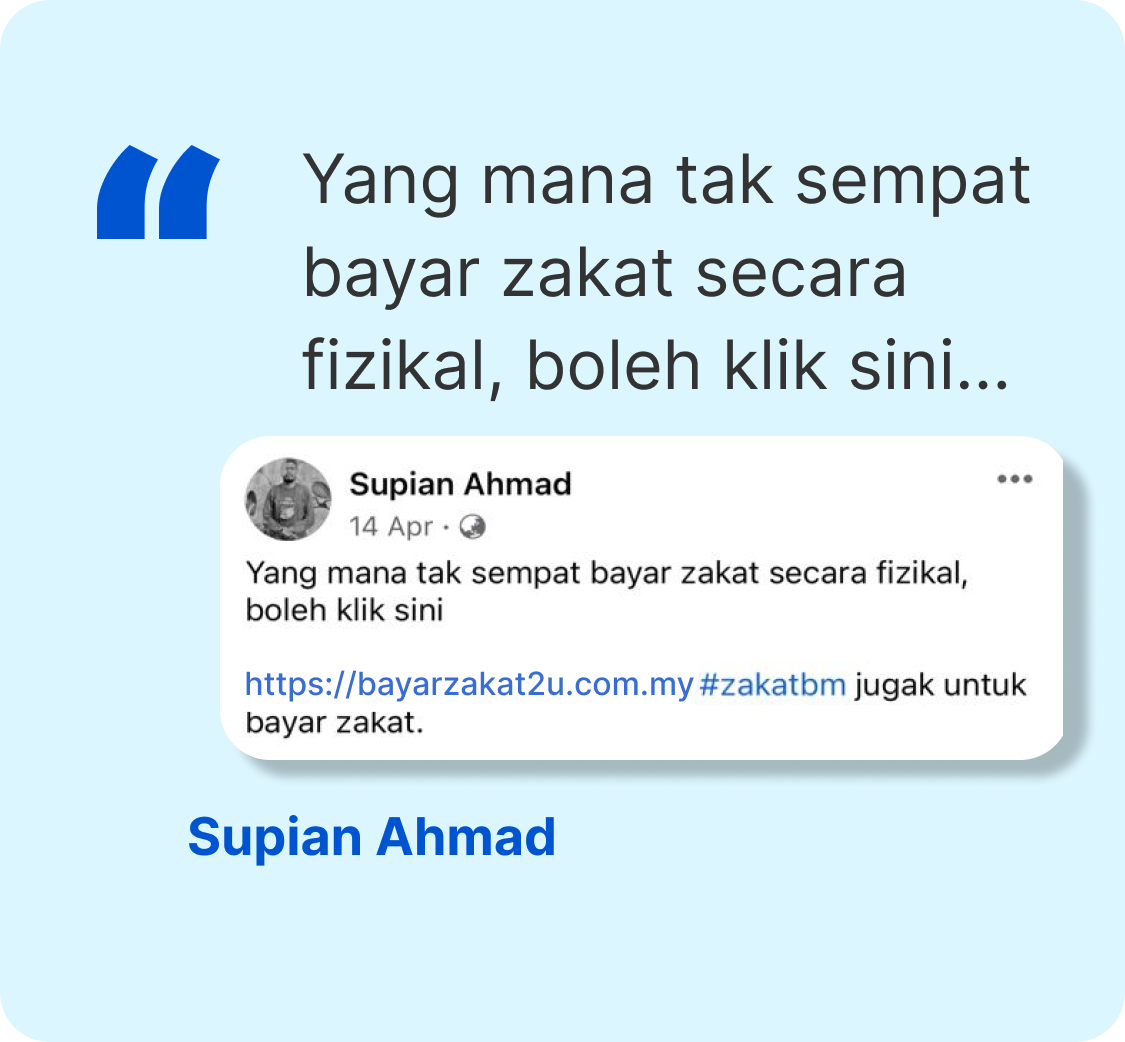

User Feedback

Zakat Payment

Zakat Calculator

Benefits of Paying Zakat

100% Individual

Tax Rebate

Zakat payers will receive 100% tax rebate from the Inland Revenue Board of Malaysia (LHDN)

2.5% Business Tax Rebate

Company will receive a 2.5% tax rebate from the Inland Revenue Board (LHDN).

Directly To Selangor Zakat Board

Your zakat payment will go directly to the bank account of the Selangor Zakat Board, without passing through any other entity's account

Zakat Distributed To Asnaf

The collection of Zakat proceeds is directly channeled to Asnaf groups in Selangor through the Selangor Zakat Board

Benefits of Paying Zakat

100% Individual Tax Rebate

Zakat payers will receive 100% tax rebates from the Inland Revenue Board of Malaysia (LHDN)

2.5% Business Tax Rebate

Company will receive a 2.5% tax rebate from the Inland Revenue Board (LHDN).

Directly To Selangor Zakat Board

Your zakat payment will go directly to the bank account of the Selangor Zakat Board, without passing through any other entity's account

Zakat Distributed

To Asnaf

The collection of Zakat proceeds is directly channeled to the Asnaf groups in Selangor through the Selangor Zakat Board

Sample of Zakat Receipt

Amil Appointment By

Lembaga Zakat Selangor

Zakat Receipt Sample

Amil Appointed By

Lembaga Zakat Selangor

Feedback & Suggestions

Copyright 2025 © All Rights Reserved.

bayarzakat2u.com.my

Zakat On Gold

It is well known that the possession of gold is a marker of a person’s level of wealth because it is a valuable commodity and its price can – in fact usually – rise higher and higher. It is an indelible metal, it cannot be burned, its color remains even when burned and melted, it is non-toxic and does not harm anyone who holds it. These are some of the reasons why it was used as a currency a long time ago and can still be traded for money. Therefore, Islam requires that gold zakat be paid by the owners based on the conditions that have been set.

Dalil About Zakat On Gold

Gold has long been identified in Islam as a valuable asset that must have zakat paid upon it. In the Qur’an there is a verse referring to the obligation to pay zakat on gold, which is as follows:

“And (remember) those who hoard gold and silver and do not spend it in the way of God, then inform them of (the punishment of) an indescribable torment. (That is) on the day that gold, silver (and property) will be burned in hell, then their foreheads, and their ribs, and their backs will be lashed with it (while saying to them): This is what you have kept for yourselves, by that is the taste (punishment of) what you kept.” (Surah At-Taubah; Verses 34-35)

Meanwhile, the Prophet SAW said, narrated by Abu Hurairah RA, which means:

“Whoever is the owner of gold and silver and does not pay his zakat, on the Day of Resurrection will be prepared for him a bed of fire heated by hell. With that fire his ribs and back will be burned.” (Sahih Muslim)

With these arguments, it is clear that zakat on gold must be paid on the gold we own.

However, exception from zakat is given if the amount of gold does not reach the value of nisab, which is 85 grams. This can be seen from the words of the Prophet SAW, which means:

“It is not obligatory on you anything on gold until there are 20 dinars (85 grams) and when it has reached the period of haul, half a dinar must be paid. Anything more than that, follows same count.” (Hadith narrated by Abu Daud)

Nisab and Haul for Zakat On Gold

There are several different calculation methods for different types of gold, gold savings and investments. First of all, referring to gold that is not used – either because it is in a form that cannot be used, or jewelry made of gold that is not used at all – if it weighs enough according to the nisab of 85 grams, and has enough haul that is for one year of storage, then it is obligatory for zakat to be issued against it. The zakat rate is 2.5% of the total value of the gold. This is equivalent to approximately RM23,035 in the second half of 2023. Therefore, if the gold used or stored is worth less than RM23,035, then no zakat is required on it.

Calculation example:

If the stored gold is worth RM25,000 (according to the current value rate), then the amount of zakat that must be paid is as follows:-

RM25,000 x 2.5% = RM625

Zakat On Gold Jewellery

In general, gold that is used at least once a year is not subject to zakat if it does not exceed the “uruf” of the country or state of residence for the zakat payer. Uruf is the local usage value that is set by the local state Islamic council. The following is the latest uruf rate for each state in Malaysia:-

Johor: 850 grams

Kedah: 170 grams

Kelantan: No uruf

Kuala Lumpur and Putrajaya: 800 grams

Malacca: 180 grams

Negeri Sembilan: 200 grams

Pahang: 500 grams

Silver: 500 grams

Perlis: 85 grams

Penang: 165 grams

Sabah: 152 grams

Sarawak: 90 grams

Selangor: 800 grams

Terengganu: 850 grams

For states where there is no uruf, this means that all jewelry made of gold must be paid zakat on, no matter how much it weighs.

Types of Gold Deposits Eligible For Zakat

Apart from stored jewellery, the types of gold on which zakat must be paid are as follows:-

Physical gold investment: Usually this physical gold takes the form of coins (but cannot be used like normal currency), wafers, bars, and sometimes it comes in a certain form for special events. If the total amount of gold savings exceeds the nisab of 85 grams, then zakat needs to be paid on these savings.

Gold account investment: There are also gold savings or investments where the amount and value is recorded in the form of an account book, account statement or passbook. Usually it is through a Gold Savings Account. In the account statement, the amount of savings invested based on gold units will be recorded. If this gold investment exceeds 85 grams or the total nisab of RM23,035, then it is obligatory to pay zakat on it. However, this invested gold must actually exist and can be physically owned by the investor if necessary. Otherwise, it falls into the category of virtual gold account or gold account without physical gold.

Gold account without physical gold: A gold account without a physical object is considered a gold deposit that does not comply with Shariah, so zakat is charged on the principal investment only. Therefore, it is counted as zakat on savings.

Virtual gold account: Similarly for virtual gold account, it is gold that is traded non-physically and only “on paper” or on an electronic platform only. This means that investors can carry out gold buying and selling activities based on the current price, but this gold cannot be claimed physically even though the investor is the “owner” of this gold. Therefore, the zakat paid has to follow the zakat rate of savings money that is charged on the principal investment only.

If you want to calculate the amount of gold zakat to be paid, use the calculator here. Thank you for paying your zakat at Bayar Zakat Malaysia!